The Main Principles Of Clark Wealth Partners

About Clark Wealth Partners

Table of ContentsSee This Report about Clark Wealth PartnersThe Main Principles Of Clark Wealth Partners Clark Wealth Partners Things To Know Before You BuyMore About Clark Wealth PartnersThe Clark Wealth Partners PDFsSome Known Incorrect Statements About Clark Wealth Partners Some Ideas on Clark Wealth Partners You Need To Know

The world of money is a difficult one., for instance, lately discovered that almost two-thirds of Americans were not able to pass a fundamental, five-question financial proficiency test that quizzed participants on topics such as interest, financial debt, and various other fairly basic principles.Along with managing their existing customers, economic advisors will certainly frequently spend a reasonable amount of time every week conference with prospective customers and marketing their solutions to keep and expand their company. For those thinking about becoming an economic consultant, it is essential to take into consideration the typical income and work security for those functioning in the area.

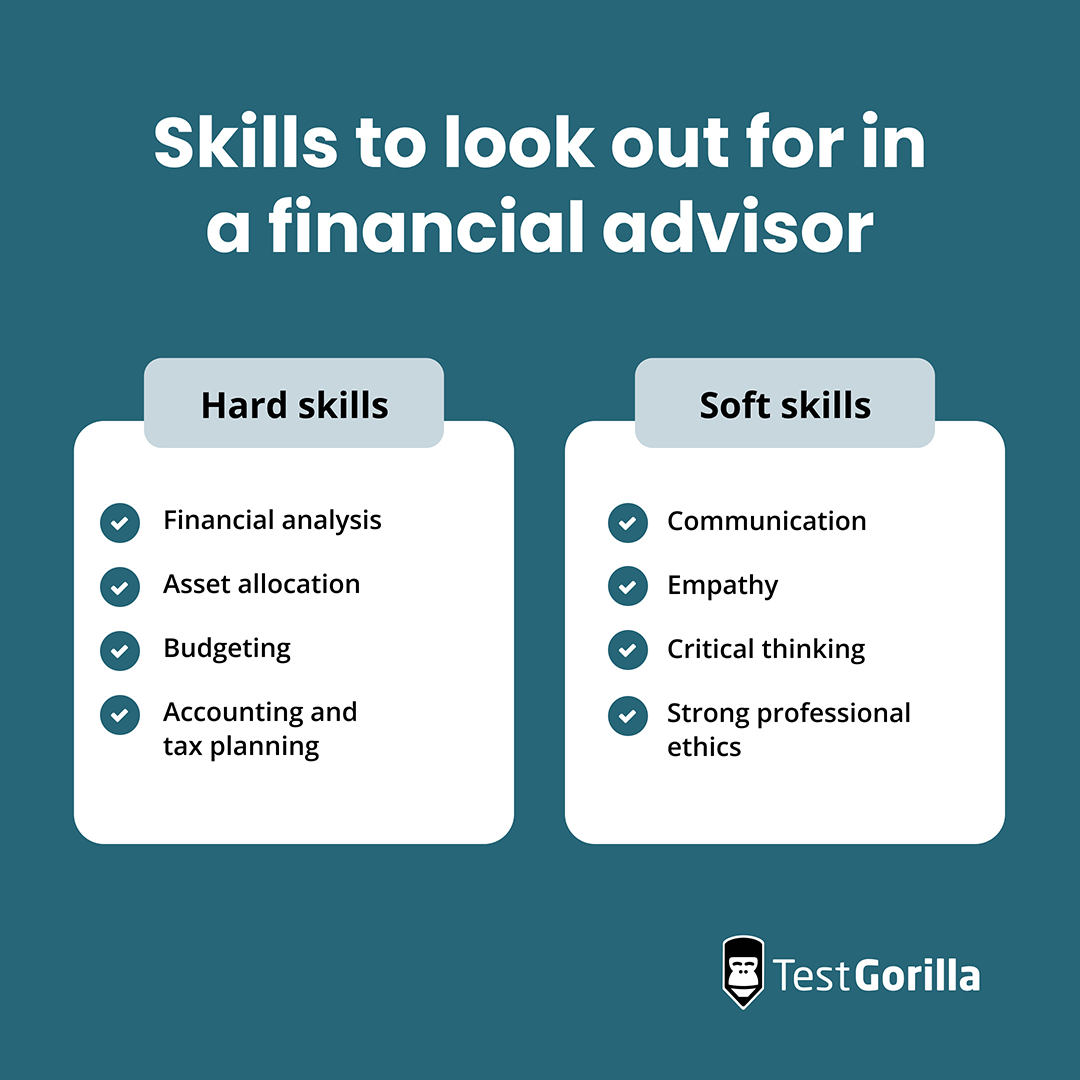

Training courses in tax obligations, estate planning, financial investments, and risk administration can be helpful for trainees on this course. Depending on your distinct job goals, you might also need to make details licenses to meet certain customers' requirements, such as acquiring and selling supplies, bonds, and insurance policy plans. It can additionally be useful to earn a qualification such as a Qualified Economic Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

See This Report on Clark Wealth Partners

What that looks like can be a number of points, and can differ depending on your age and phase of life. Some people worry that they need a particular quantity of cash to spend prior to they can get aid from a specialist (financial advisors Ofallon illinois).

The 15-Second Trick For Clark Wealth Partners

If you have not had any experience with an economic advisor, right here's what to anticipate: They'll begin by supplying a complete assessment of where you stand with your possessions, liabilities and whether you're satisfying standards compared to your peers for cost savings and retired life. They'll evaluate short- and long-term objectives. What's practical about this step is that it is individualized for you.

You're young and working full time, have a car or more and there are trainee financings to repay. Here are some feasible ideas to help: Establish great financial savings habits, settle financial debt, established baseline goals. Pay off trainee loans. Depending on your occupation, you might certify to have component of your college car loan forgoed.

The Only Guide to Clark Wealth Partners

You can review the next finest time for follow-up. Financial advisors generally have various tiers of rates.

You're looking in advance to your retirement and assisting your children with greater education expenses. A financial consultant can supply guidance for those circumstances and more.

6 Simple Techniques For Clark Wealth Partners

That might not be the ideal method to keep building riches, particularly as you advance in your occupation. Set up normal check-ins with your organizer to fine-tune your strategy as required. Stabilizing financial savings for retirement and college prices for your youngsters can be complicated. An economic expert can aid you focus on.

Considering when you can retire and what post-retirement years may appear like can generate problems regarding whether your retired life financial savings remain in line with your post-work plans, or if you financial advisor st. louis have actually conserved enough to leave a legacy. Help your economic expert recognize your strategy to cash. If you are more conventional with conserving (and potential loss), their ideas need to reply to your worries and worries.

The Clark Wealth Partners Statements

Planning for wellness care is one of the huge unknowns in retirement, and a financial expert can outline alternatives and recommend whether additional insurance policy as defense may be handy. Prior to you begin, try to get comfy with the concept of sharing your whole monetary photo with an expert.

Giving your professional a full image can aid them produce a plan that's focused on to all components of your financial standing, specifically as you're quick approaching your post-work years. If your financial resources are basic and you have a love for doing it yourself, you might be great on your own.

An economic consultant is not only for the super-rich; any individual encountering major life changes, nearing retired life, or sensation overwhelmed by economic decisions might gain from specialist guidance. This write-up explores the duty of monetary advisors, when you might require to speak with one, and key factors to consider for choosing - https://www.reddit.com/user/clrkwlthprtnr/. A financial advisor is an experienced expert that assists clients manage their funds and make notified decisions that align with their life goals

The Of Clark Wealth Partners

Payment models likewise differ. Fee-only advisors charge a level charge, hourly rate, or a percent of possessions under monitoring, which has a tendency to decrease potential problems of rate of interest. On the other hand, commission-based advisors make earnings through the financial items they market, which might influence their suggestions. Whether it is marriage, separation, the birth of a youngster, occupation modifications, or the loss of a loved one, these occasions have special financial implications, commonly needing timely decisions that can have lasting effects.